EPFO UAN Services, UAN Member e-Sewa, OLRE Portal Registration, ECR / Challan Submission, Pradhan Mantri Rojgar Protsahan Yojana (PMRPY) check at UnifiedPortal.EpfIndia.gov.in…..

The paramount obligation for Employee Provident Fund Organization (EPFO) is to extend the range and quality of old age income security programs that are publicly managed. EPFO official website is https://unifiedportal.epfindia.gov.in/. This is done through steady and every other day-improving compliance levels and benefits delivery in a way that wins the confidence and the acceptance of members in our fairness, methods, integrity and honesty. This contributes to the social and economic well-being of India as a nation.

For those who followed up on their money, it took them so much time before they would finally lay their hands on it that they never enjoyed it. This discouraged people from joining the organization as they referred it as an easy way of losing their money.

Overview on unifiedportal.epfindia.gov.in website

Our easy to use and technology driven services are envisaged to develop the trust level on the functioning of this organization. These include:

- Deliver minimum interface but yield a lot from the EPFO offices.

- Reliable and improved facility for online services.

- Swift monthly updating of member accounts.

- Online access to member.

- Reduction of settlement time to 3 days from the current 20 days.

- Compliance facilitation made easy

- Keep watch and ensure full compliance by all employers.

- Facilitate easy relationship with EPFO in getting information

- Make sure only one account is assigned to one employee

History of EPFO

Unifiedportal.epfindia.gov.in and epfindia.gov.in website is one of the world’s biggest Social Security Organization when it comes to volume of financial operation undertaken and the clientele. To begin with, it maintains more than fifteen accounts that belong to its members.

The Employees Provident Fund was birthed with the proclamation of EPF Ordinance on November 15th 1951. This was then replaced by the employees by revised EPF Act the following year (1952). This Bill (EPF Bill) was introduced to the parliament of the year 1952 as Bill number 15.

It was meant to stand as a Bill of providing the institution of provident funds for the sake of employees in factories, industries and other establishments. Though the Act is still in action, it has changed to the EPF and the Miscellaneous Provisions Act of 1952.

EPF Schemes at unifiedportal.epfindia.gov.in

Employees Provident Funds has several different schemes that offer different packages. These packages include:

EPF Schemes 1952

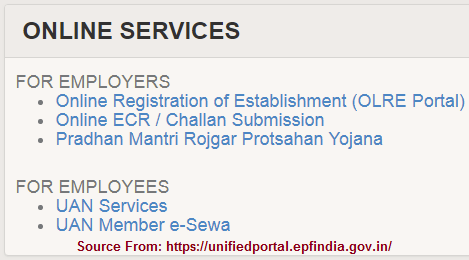

Recently, the Organization has launched an OLRE (Online Registration of Establishment) platform. This is important in assigning PF registration code number. This has made things easier because you can do this at the comfort of your house. This unifiedportal.epfindia.gov.in has provision for both the employer and the employee. The two have different guidelines and forms to follow and they are divided as indicated below:

For employers

There are three main provisions for the employer. These are:

- Registration of Establishment (OLRE Portal)

- ECR /Challan Online Submission

- PMRPY

OLRE Portal (Registration of Establishment Online) at unifiedportal.epfindia.gov.in

There are various new processes that have to be followed by the employers who want to apply for PF Code Number (Registration). The employer will also be expected to upload some documents that will be Digitally Signed. These documents will be expected to be submitted during the application process.

There is a digital signature that is submitted and it is supposed to be in the name of the employer. His name will then be automatically populated in the right section (“Employers Details”) fields available only in the online application. The PAN of the applicant (applying employer) applying online also needs to be verified before the applicant continues with the process.

It is important to understand that not all employers will be allowed to apply or file their application online. It is therefore important to know your category before kicking off into the application process other spending time in it and it ends up failing you. Below is a list of the employers allowed to do online application:

- Establishment where the Act applies but the employer backed by the consent of most of his/her employees’ wishes voluntarily.

- Establishment where the employer already has a code number but wishes to apply for another code number to be used in another Branch unit. This is mostly done for administrative convenience (this is done through ECR Login).

- The online application can also be done on institutions to which the EPF and MP 1952 provisions Act apply.

- The Online Code Number can also be done where the existing institution that has an already existing Code number and does not need to apply for another code. However, they have the facility of filling up an online Form 5A through ECR Login.

For the employer to successfully apply for Post Allotment of Code Number he or she needs to do the following:

- The employer is required to submit the PF due via the Electronic returns platform Challan Cum

- The EPFO has provided their members with an E-return tool to assist in generation of ECR files.

- Duties of employer in accordance to the 1952 MP and EPF Act.

ECR / Challan online Submission in unifiedportal.epfindia.gov.in

This ECR Online Submission will be available at https://unifiedportal.epfindia.gov.in/ website. In that web portal you can see right side of your screen “Online Services” will be there. Under that ECR / Challan Online Submission will be there. It is able to access the ECR, you need to create your user ID and password. You can do this through the Unified portal. The registered employer can choose to upload the ER. The uploaded return data is then displayed in a PDF format through a copy signed digitally. This can also be printed for future use.

The employer can also decide to take a Challan print out and pay at any selected branch of SBI (State Bank of India) or pay through SBI internet banking platform. Below are a number of advantages of ECR.

- No need of preparing paper return to be submitted to EPFO.

- There is no need of submitting other returns viz Form 6A and 5/10/12A,3A.

- Employer gets confirmation of the payment instantly through an SMS.

- The contribution is credited to the employer’s account on monthly basis.

- The member is able to view the yearly accounts slip for the previous accounting year online.

For earlier years, members can request for the yearly slips through this unifiedportal.epfindia.gov.in.

Points to note

- Employers are expected to download the Missing Details File (usually in excel format) from the Downloads Tag available after E-Sewa Login. Compile the file and upload it.

- If the employer had submitted and erroneous ECR file in the past year, he/she can generate the correct ECR then contact EPFO office.

PMRPY (Pradhan Mantri Rojgar Protsahan Yojana) website pmrpy.gov.in

The Pradhan Mantri Rojgar Protsahan Yojana (PMRPY) Plan Scheme has been tailor-made to incentivize employers for creation of new employment. The official web portal for PMRPY scheme is https://pmrpy.gov.in/. The Govt of India comes to an agreement with the employers to be paying the 8.33% of EPS contribution of this employer for the newly created employment.

The PMRPY Plan Scheme has a double benefit. This is because, on one hand, it incentivizes the employer for increasing the occupation base of workers in his institution. On the other hand, it increases the numbers of employees who get hired by the institution. A direct benefit to the workers is that they get access to social security welfares of the organized sector.

There are a few mandatory requirements when joining the PMRPY Plan Scheme as indicated below:

- Any establishment that wishes to be a member of this scheme must have an LIN assigned to them. This is done under Shram Suvidha Portal.

- The employee must also have a validly connected Aadhaar, UAN and wages of less than 15,000 rupees.

- Registration on PMRPY portal is mandatory to access the benefits.

- In case of a textile sector institution, they are entitled to get 3.67% of the EPF contribution.

- Any employer who wishes to apply for the cover shall be fully responsible for any information uploaded. If in anyway the information or part of the information submitted is not correct, the employer will be penalized for the dues as stated and explained under 1952 EPFO provisions.

Employer’s UAN Portal https://unifiedportal.epfindia.gov.in

For establishment, create a permanent login id together with your password. In any case that you forget your password, use the link forgot password and you will receive a text on your phone that you registered. In a worst case scenario and your account get blocked for using wrong password repeatedly, you can use the unlock account link provided.

For Employees

Each providence fund contributing member will be provided with a Universal Account Number (UAN) by EPF Organization. This account number will serve as a cover for multiple Ids a member has been given by different employers. The aim of this is to connect multiple member Ids given to one member with just one Universal Account Number.

The single Universal Account Number will be of much help when a member is viewing all his identification numbers linked to him. This will save a member a lot of time as every detail of his identification is under one account.

When a member changes from one establishment to another, he/she must provide his Universal Account Number to his new employer. This is for the sake of helping the new employer mark your new Member Identification Number in your Universal Account Number. The paramount reason behind this new function of identification is to capture all KYC details of every member. This eliminates the employer’s dependency which makes the quality the services improve.

The information in the KYC is tagged against the UAN given instead of the member id. This eliminates any duplication or error in your member accounts.

Declaration Form

Any person taking up any position in an establishment where EPFO is applicable is required to fill in a declaration form. I this form you are required to fill in the following information:

- Your full names

- Your correct dates of birth

- Your father of husband’s name

- Your relationship with the above named person

- Choose your gender either Male or Female.

- Your mobile phone number if in any case you own one

- Your email address on you have one

- Whether you have ever been a member of the scheme 1952. Please tick where applicable

- If earlier you have been a member of 1995 employee’s scheme. Tick in the correct box

If you answer any of the above two questions affirmatively, then it’s mandatory for you to fill the previous employment form which is readily available online.

Previous employment Form

The following details must be filled correctly in this form

- Correct details of your UAN

- The exit date for the previous member

- If you had a scheme certificate issued in your previous employment, give the certificate number

- If in your previous employment you were issued with a Pension Payment order, give the PPO number

- Click where applicable on whether you are an international worker or not.

- If you are an international worker, then must indicate the country of origin, passport number and validity period of your passport.

- Enter details of your academic qualifications

- Tick your current marital status

- Tick if you are specially abled or not if yes, choose your category in the choices given.

- Enter your KYC details

- After filing in all the correct details in your previous employment form, append your signature and the current date.

- The last portion is to be filled by your current employer with details of your new assigned PF member id and KYC details.

User Manual

For more information on UAN functions, you may download the user manual in UAN Driven Member Portal. In the manual, you will find all the detailed functions of UAN unified in the unifiedportal.epfindia.gov.in. This will help the employer in completing form 11 linking with the employee’s previous employment.

To the employer, you don’t need to upload images of KYC documents scanned but you must upload the information in the text file as early as possible.

Using UMANG

This a new age Governance mobile application developed by Electronics an Information Ministry in conjunction with the National e-Gorvernance Division. The application’s main purpose is to helping in mobile governance in India.

For all government services on online platform can be accessed through this application with a lot of ease. These services range from local government to central bodies. The application intends to give services offered by both governments departments i.e. central and state government. This provides a unified platform where all Indian people can access multiple government services through one application.

The app has been made accessible on mobile applications and several other online platforms like IVR, Web and SMS. With the help of a Smartphone you can access Umang services. Umang has today revolutionized how Indian citizens access government services. With the use of smart phones and internet being on the rise, Umang will only bring government services closer to its people.

DEAR SIR/MADAM, I AM SHEELA JAYAKARAN, i am getting my UAN number please help

DEAR SIR/MADAM

I HOLD UAN NO BUT I WANT TO E-PASSBOOK SO I HAVE TRIED TO LOGIN BUT I AM NOT RAGISTERD SO PLEASE GIVE ME ADVISE HOW TO USE ONLINE E-PASSBOOK AND RAGISTER LOGIN ID AND PASSWORD

Dear Team,

Myself Ajay Kumar having UAN No. 100434999831 and MY PF balance is pending from last 2 organisations named as Calibehr Human Serivces P Ltd and HDB Financial Services Ltd.

I did work with Calibehr for 10 months approx and with HDB approx 31 months approx. Now i want to withdrawls my PF amount from these organisations. I have checked this in online weblise of EPFO.GOV.IN but there is no option found to withdrawn my PF amount.

Request your guidance.

Regards

Ajay Kumar

UAN No. 100434999831

09501687876

email id – [email protected]